Housing Finance Kenya has several branches across the country where customers can access its services. Below is a list of some of the Housing Finance branches in Kenya:

Housing Finance Kenya Head Office

Rehani House, Kenyatta Avenue / Koinange Street

Mobile numbers: 0709 438 000 & 0709 438 888

Toll-Free Number: 0800 721 400

Email: customer.service@hfgroup.co.ke or mybank@hfgroup.co.ke

Chat on WhatsApp with HF Whizz

Gill House HFC Branch

Moi Avenue

0709438576 0709438656 0709438517

Gillhouse.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Gill House HFC Branch

Moi Avenue

0709438576 0709438656 0709438517

Gillhouse.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Kitengela HFC Branch – Newton House

Nairobi – Namanga Road

Tel: 0714412374 0714412785

Kitengela.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Sameer Park

Msa Road

0709438426 0709438654 0709438652

Sameer.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Westlands – Sky park plaza

Waiyaki Way

0709438637 0709438639 0709438640

Westlands.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

TRM

Thika Road

0709438606 0709438505 0709438673/671

Trm.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Komarock Mall

Nairobi

0709438550 0709438152 0709438675

komarock.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Rehani house

Koinange Street/Kenyatta Avenue

0709438591

0709438240

0709438638

0709438417

0709438303

Rehani.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Kose Heights

Hurlingham

020 326 2219/ 0709 438 219

020 326 2711/ 0709 438 711

020 326 2187/ 0709 438 187

Hurlingham.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Weaverbird Building

RiverRoad

0709438722 0709438158 0709438286

Riverroad.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Ongata Rongai

Magadi Road

0795 744 350

Rongai.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Mombasa Hfc Branch

Permanent House

Moi Avenue

0709438112 0709438122 0709438115

Mombasa.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Nakuru HFC

AFC Building

Geoffrey Kamau Way

0709438127

0709438682

0709438119

Nakuru.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Nyeri HFC

Meghirutshi Building

Kimathi Way

0709438621

0709438153

0709438261

Nyeri.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Eldoret HFC

KVDA Plaza

Oloo/Utalii Street

0709438191

0709438184

Eldoret.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Kisumu HFC

Tivoli Centre

Court Road

0709438501

0709438502

0709438701

Kisumu.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

THIKA

Wangu Boots

Uhuru Street

0709438551

0709438310

0709438547

thika.branch@hfgroup.co.ke

Weekday: 8.30am – 3.00pm

Saturday: 8.30am – 12 noon

Sunday: closed

Meru

Tom Mboya Street

0203262622

0203262627

Meru.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Meru

Tom Mboya Street

0203262622

0203262627

Meru.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Machakos HFC

Kivuvo Building

Machakos

070943853207094383290709438133

Machakos.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Nanyuki HFC

Kiangima Building

Kenyatta Avenue

0709 438 111

0709 438 172

0709 438 156

Nanyuki.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

Embu HFC

BEEKAY BUILDING

KUBU KUBU ROAD

0203262450

0724315253

0203262063

0203262546

Embu.branch@hfgroup.co.ke

Weekdays 8.30am – 4pm

Saturdays 8.30am – 12pm

Sundays & Public Holidays – Closed

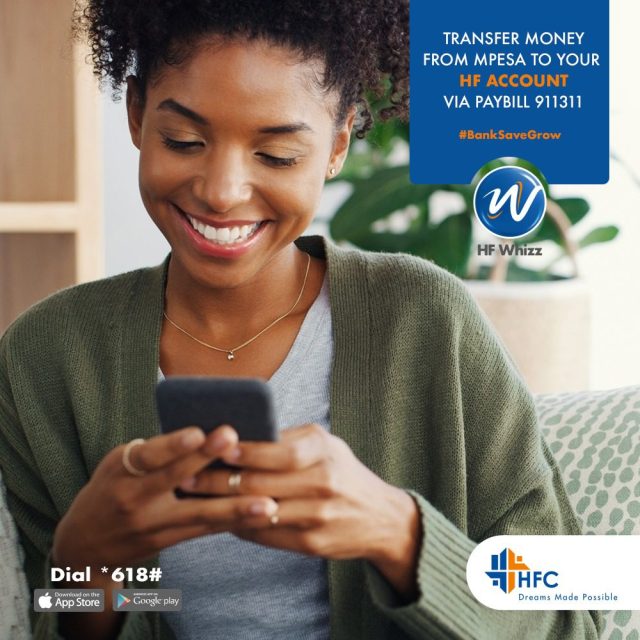

How to Deposit Funds to HFC via Mpesa Paybill

Note: If you are using Microsoft Office Excel 2007, please follow these easy steps to save your byproduct in the necessary format:

Note: If you are using Microsoft Office Excel 2007, please follow these easy steps to save your byproduct in the necessary format: