How does electronic tax invoicing work in Kenya ?

Q: When did the electronic tax invoice regulations become effective in Kenya, and who needs to comply with them?

A: The electronic tax invoice regulations were enacted on August 1, 2021, and are mandatory for all VAT-registered taxpayers in Kenya.

Q: How long do organizations have to comply with electronic tax invoicing?

A: The Kenya Revenue Authority (KRA) provided a one-year transition period from August 1, 2021, to July 31, 2022. The deadline for compliance with TIMS (Tax Invoice Management System) was extended to November 30, 2022.

Q: Can taxpayers apply for an extension if they cannot comply with the regulations within a year?

A: Yes, taxpayers who are unable to comply with the timelines given can apply for an extension to the Commissioner. The extension period should not exceed six months, according to the regulations.

Q: What is TIMS?

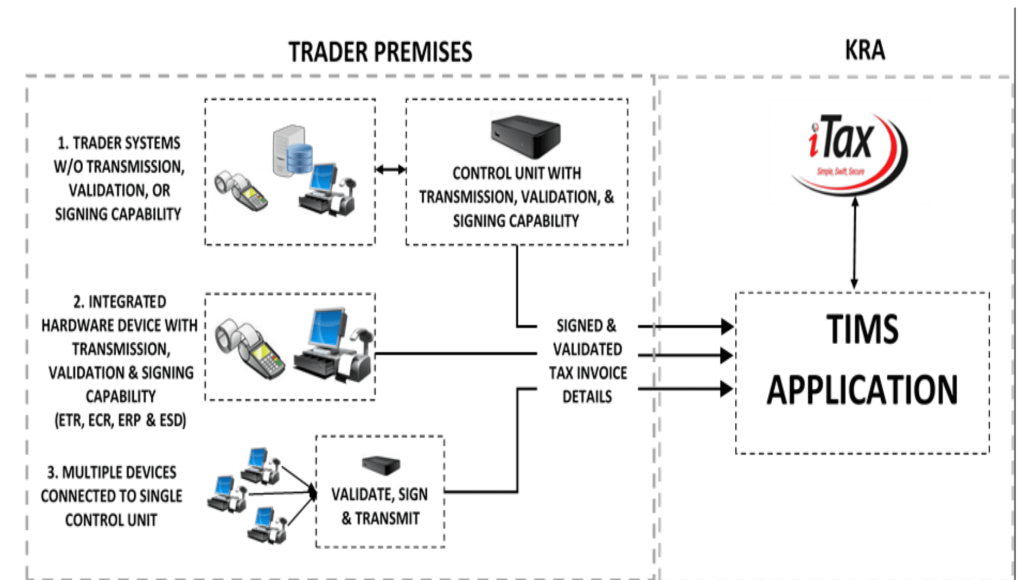

A: TIMS (Tax Invoice Management System) is an upgraded version of the ETR (Electronic Tax Register) system introduced in 2005 to achieve VAT compliance and reduce VAT fraud. TIMS aims to standardize tax invoice generation and receipt, simplify tax return filing, and provide real-time invoice validation and continuous invoice data verification to prevent tax fraud. TIMS integrates seamlessly with trader systems such as Electronic Tax Register, Enterprise Resource Planning, Point of Sale systems, and iTax. It is also responsible for storing tax invoices and providing information on the validity of tax invoices by mandating invoice QR codes or tax checkers on the iTax portal.

Q: What are the criteria that taxpayers need to fulfil before applying for electronic tax invoicing? A: Before achieving compliance, taxpayers must fulfil the following conditions:

- Be VAT-registered under the provisions of the VAT Act 2013

- Own an invoicing system to transmit invoices to KRA

- Have uninterrupted internet connectivity

Q: What are the mandatory fields in a tax invoice in Kenya?

A: Each invoice should contain the following mandatory fields:

- Register the PIN of the user

- Time and date

- Serial number

- Buyer’s PIN

- Total gross amount

- Total tax amount

- Item code as prescribed by the Commissioner, according to the ACT

- Description of items being sold

- Quantity of supply

- Unit of measurement

- The tax rate charged on each item

- Unique register identifier

- Unique invoice identifier

- QR code

Q: What happens when there is a change in the VAT rate in Kenya?

A: ETR suppliers will update the tax register so that traders can see the changes.

Q: What happens if the internet connection gets disconnected?

A: If the internet connection gets disconnected, the taxpayer can continue to use the tax register. Once internet connectivity is restored, the invoices stored in the tax register’s memory get transmitted to KRA.

Q: What should I do if there’s a tax register malfunction?

A: The registered taxpayer is responsible for ensuring that the register is functional at all times and arranging for backup in case of power outages. In case the register stops working, the registered person must notify the Commissioner within 24 hours of malfunction. Furthermore, the transactions will be recorded by any alternate means prescribed by the Commissioner until the register is fixed and the entries are repeated into the register.

Q: Is it necessary to have an ETR even if the billing system is automated?

A: Yes, it is necessary to have a compliant ETR despite having an automated billing system. Non-compliance with the VAT regulations is punishable in Kenya, and the taxpayer will attract penalties as per the rules specified in Section 63 of the VAT Act 2013.

How does electronic tax invoicing work in Kenya ?